//+——————————————————————+

//| Traders Dynamic Index.mq4 |

//| Copyright ?2006, Dean Malone |

//| www.compassfx.com |

//+——————————————————————+

//+——————————————————————+

//| |

//| Traders Dynamic Index |

//| |

//| This hybrid indicator is developed to assist traders in their |

//| ability to decipher and monitor market conditions related to |

//| trend direction, market strength, and market volatility. |

//| |

//| Even though comprehensive, the T.D.I. is easy to read and use. |

//| |

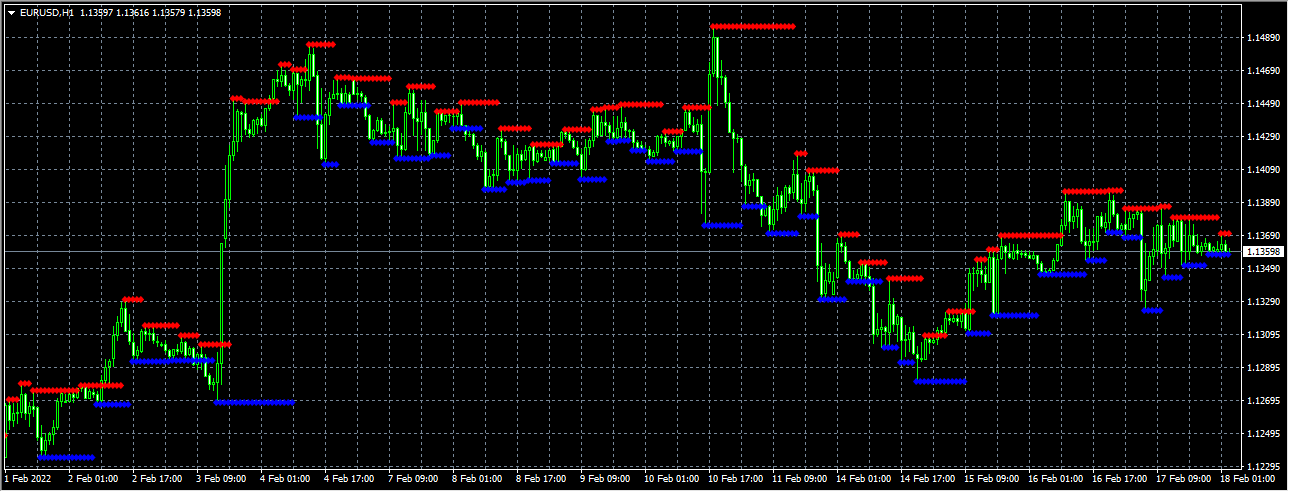

//| Green line = RSI Price line |

//| Red line = Trade Signal line |

//| Blue lines = Volatility Band |

//| Yellow line = Market Base Line |

//| |

//| Trend Direction – Immediate and Overall |

//| Immediate = Green over Red…price action is moving up. |

//| Red over Green…price action is moving down. |

//| |

//| Overall = Yellow line trends up and down generally between the |

//| lines 32 & 68. Watch for Yellow line to bounces off |

//| these lines for market reversal. Trade long when |

//| price is above the Yellow line, and trade short when |

//| price is below. |

//| |

//| Market Strength & Volatility – Immediate and Overall |

//| Immediate = Green Line – Strong = Steep slope up or down. |

//| Weak = Moderate to Flat slope. |

//| |

//| Overall = Blue Lines – When expanding, market is strong and |

//| trending. When constricting, market is weak and |

//| in a range. When the Blue lines are extremely tight |

//| in a narrow range, expect an economic announcement |

//| or other market condition to spike the market. |

//| |

//| |

//| Entry conditions |

//| Scalping – Long = Green over Red, Short = Red over Green |

//| Active – Long = Green over Red & Yellow lines |

//| Short = Red over Green & Yellow lines |

//| Moderate – Long = Green over Red, Yellow, & 50 lines |

//| Short= Red over Green, Green below Yellow & 50 line |

//| |

//| Exit conditions* |

//| Long = Green crosses below Red |

//| Short = Green crosses above Red |

//| * If Green crosses either Blue lines, consider exiting when |

//| when the Green line crosses back over the Blue line. |

//| |

//| |

//| IMPORTANT: The default settings are well tested and proven. |

//| But, you can change the settings to fit your |

//| trading style. |

//| |

//| |

//| Price & Line Type settings: |

//| RSI Price settings |

//| 0 = Close price [DEFAULT] |

//| 1 = Open price. |

//| 2 = High price. |

//| 3 = Low price. |

//| 4 = Median price, (high+low)/2. |

//| 5 = Typical price, (high+low+close)/3. |

//| 6 = Weighted close price, (high+low+close+close)/4. |

//| |

//| RSI Price Line & Signal Line Type settings |

//| 0 = Simple moving average [DEFAULT] |

//| 1 = Exponential moving average |

//| 2 = Smoothed moving average |

//| 3 = Linear weighted moving average |

//| |

//| Good trading, |

//| |

//| Dean |

//+——————————————————————+

#property indicator_buffers 6

#property indicator_color1 Black

#property indicator_color2 MediumBlue

#property indicator_color3 Yellow

#property indicator_color4 MediumBlue

#property indicator_color5 Green

#property indicator_color6 Red

#property indicator_separate_window

extern int RSI_Period = 13; //8-25

extern int RSI_Price = 0; //0-6

extern int Volatility_Band = 34; //20-40

extern int RSI_Price_Line = 2;

extern int RSI_Price_Type = 0; //0-3

extern int Trade_Signal_Line = 7;

extern int Trade_Signal_Type = 0; //0-3

double RSIBuf[],UpZone[],MdZone[],DnZone[],MaBuf[],MbBuf[];

int init()

{

IndicatorShortName(“Traders Dynamic Index”);

SetIndexBuffer(0,RSIBuf);

SetIndexBuffer(1,UpZone);

SetIndexBuffer(2,MdZone);

SetIndexBuffer(3,DnZone);

SetIndexBuffer(4,MaBuf);

SetIndexBuffer(5,MbBuf);

SetIndexStyle(0,DRAW_NONE);

SetIndexStyle(1,DRAW_LINE);

SetIndexStyle(2,DRAW_LINE,0,2);

SetIndexStyle(3,DRAW_LINE);

SetIndexStyle(4,DRAW_LINE,0,2);

SetIndexStyle(5,DRAW_LINE,0,2);

SetIndexLabel(0,NULL);

SetIndexLabel(1,”VB High”);

SetIndexLabel(2,”Market Base Line”);

SetIndexLabel(3,”VB Low”);

SetIndexLabel(4,”RSI Price Line”);

SetIndexLabel(5,”Trade Signal Line”);

SetLevelValue(0,50);

SetLevelValue(1,68);

SetLevelValue(2,32);

SetLevelStyle(STYLE_DOT,1,DimGray);

return(0);

}

int start()

{

double MA,RSI[];

ArrayResize(RSI,Volatility_Band);

int counted_bars=IndicatorCounted();

int limit = Bars-counted_bars-1;

for(int i=limit; i>=0; i–)

{

RSIBuf[i] = (iRSI(NULL,0,RSI_Period,RSI_Price,i));

MA = 0;

for(int x=i; x<i+Volatility_Band; x++) {

RSI[x-i] = RSIBuf[x];

MA += RSIBuf[x]/Volatility_Band;

}

UpZone[i] = (MA + (1.6185 * StDev(RSI,Volatility_Band)));

DnZone[i] = (MA – (1.6185 * StDev(RSI,Volatility_Band)));

MdZone[i] = ((UpZone[i] + DnZone[i])/2);

}

for (i=limit-1;i>=0;i–)

{

MaBuf[i] = (iMAOnArray(RSIBuf,0,RSI_Price_Line,0,RSI_Price_Type,i));

MbBuf[i] = (iMAOnArray(RSIBuf,0,Trade_Signal_Line,0,Trade_Signal_Type,i));

}

//—-

return(0);

}

double StDev(double& Data[], int Per)

{return(MathSqrt(Variance(Data,Per)));

}

double Variance(double& Data[], int Per)

{double sum, ssum;

for (int i=0; i<Per; i++)

{sum += Data[i];

ssum += MathPow(Data[i],2);

}

return((ssum*Per – sum*sum)/(Per*(Per-1)));

}

//+——————————————————————+

相关资源

暂无评论...