//+——————————————————————+

//| Traders Dynamic Index VISUAL ALERTS.mq4 |

//+——————————————————————+

//+——————————————————————+

//| Traders Dynamic Index.mq4 |

//| Copyright ?2006, Dean Malone |

//| www.compassfx.com |

//+——————————————————————+

//+——————————————————————+

//| |

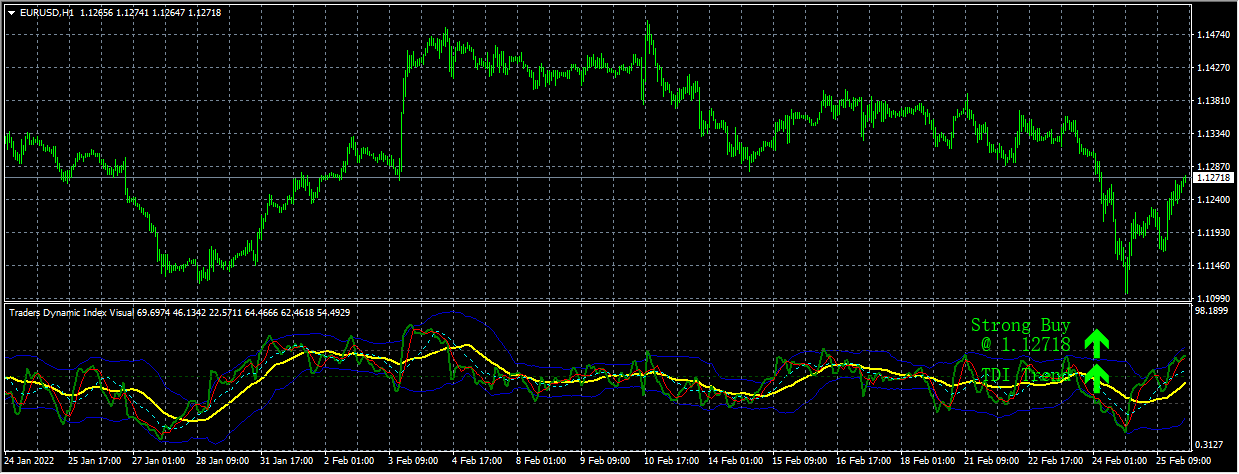

//| Traders Dynamic Index |

//| |

//| This hybrid indicator is developed to assist traders in their |

//| ability to decipher and monitor market conditions related to |

//| trend direction, market strength, and market volatility. |

//| |

//| Even though comprehensive, the T.D.I. is easy to read and use. |

//| |

//| Green line = RSI Price line |

//| Red line = Trade Signal line |

//| Blue lines = Volatility Band |

//| Yellow line = Market Base Line |

//| |

//| Trend Direction – Immediate and Overall |

//| Immediate = Green over Red…price action is moving up. |

//| Red over Green…price action is moving down. |

//| |

//| Overall = Yellow line trends up and down generally between the |

//| lines 32 & 68. Watch for Yellow line to bounces off |

//| these lines for market reversal. Trade long when |

//| price is above the Yellow line, and trade short when |

//| price is below. |

//| |

//| Market Strength & Volatility – Immediate and Overall |

//| Immediate = Green Line – Strong = Steep slope up or down. |

//| Weak = Moderate to Flat slope. |

//| |

//| Overall = Blue Lines – When expanding, market is strong and |

//| trending. When constricting, market is weak and |

//| in a range. When the Blue lines are extremely tight |

//| in a narrow range, expect an economic announcement |

//| or other market condition to spike the market. |

//| |

//| |

//| Entry conditions |

//| Scalping – Long = Green over Red, Short = Red over Green |

//| Active – Long = Green over Red & Yellow lines |

//| Short = Red over Green & Yellow lines |

//| Moderate – Long = Green over Red, Yellow, & 50 lines |

//| Short= Red over Green, Green below Yellow & 50 line |

//| |

//| Exit conditions* |

//| Long = Green crosses below Red |

//| Short = Green crosses above Red |

//| * If Green crosses either Blue lines, consider exiting when |

//| when the Green line crosses back over the Blue line. |

//| |

//| |

//| IMPORTANT: The default settings are well tested and proven. |

//| But, you can change the settings to fit your |

//| trading style. |

//| |

//| |

//| Price & Line Type settings: |

//| RSI Price settings |

//| 0 = Close price [DEFAULT] |

//| 1 = Open price. |

//| 2 = High price. |

//| 3 = Low price. |

//| 4 = Median price, (high+low)/2. |

//| 5 = Typical price, (high+low+close)/3. |

//| 6 = Weighted close price, (high+low+close+close)/4. |

//| |

//| RSI Price Line & Signal Line Type settings |

//| 0 = Simple moving average [DEFAULT] |

//| 1 = Exponential moving average |

//| 2 = Smoothed moving average |

//| 3 = Linear weighted moving average |

//| |

//| Good trading, |

//| |

//| Dean |

//+——————————————————————+

#property indicator_buffers 7

#property indicator_color1 Black

#property indicator_color2 MediumBlue

#property indicator_color3 Yellow

#property indicator_color4 MediumBlue

#property indicator_color5 Green

#property indicator_color6 Red

#property indicator_color7 Aqua

#property indicator_style7 2

#property indicator_separate_window

//#property indicator_maximum 85

//#property indicator_minimum 15

extern bool Show_VISUAL_Alerts = true;

extern int SHIFT_Sideway = 0;

extern int SHIFT_Up_Down = 0;

extern int RSI_Period = 13; //8-25

extern int RSI_Price = 0; //0-6

extern int Volatility_Band = 34; //20-40

extern int RSI_Price_Line = 2;

extern int RSI_Price_Type = 0; //0-3

extern int Trade_Signal_Line = 7;

extern bool SHOW_Trade_Signal_Line2 = true;

extern int Trade_Signal_Line2 = 18;

extern int Trade_Signal_Type = 0; //0-3

#define UPPERLINE “UPPERLINE”

#define MEDLINE “MEDLINE”

#define LOWERLINE “LOWERLINE”

double RSIBuf[],UpZone[],MdZone[],DnZone[],MaBuf[],MbBuf[],McBuf[];

int init()

{

IndicatorShortName(“Traders Dynamic Index Visual”);

SetIndexBuffer(0,RSIBuf);

SetIndexBuffer(1,UpZone);

SetIndexBuffer(2,MdZone);

SetIndexBuffer(3,DnZone);

SetIndexBuffer(4,MaBuf);

SetIndexBuffer(5,MbBuf);

if(SHOW_Trade_Signal_Line2 ==true){SHOW_Trade_Signal_Line2=DRAW_LINE; }

else {SHOW_Trade_Signal_Line2=DRAW_NONE; }

SetIndexStyle(6,SHOW_Trade_Signal_Line2);

SetIndexBuffer(6,McBuf);

SetIndexStyle(0,DRAW_NONE);

SetIndexStyle(1,DRAW_LINE);

SetIndexStyle(2,DRAW_LINE,0,2);

SetIndexStyle(3,DRAW_LINE);

SetIndexStyle(4,DRAW_LINE,0,2);

SetIndexStyle(5,DRAW_LINE,0,1);

SetIndexLabel(0,NULL);

SetIndexLabel(1,”VB High”);

SetIndexLabel(2,”Market Base Line”);

SetIndexLabel(3,”VB Low”);

SetIndexLabel(4,”RSI Price Line”);

SetIndexLabel(5,”Trade Signal Line”);

SetIndexLabel(6,”Trade Signal2 Line”);

/* SetLevelValue(0,50);

SetLevelValue(1,68);

SetLevelValue(2,32);

SetLevelStyle(STYLE_DOT,1,DarkSlateGray);*/

return(0);

}

int deinit()

{

ObjectsDeleteAll(0,OBJ_TREND);

ObjectDelete(“TDI_SIG”);ObjectDelete(“TDI_SIG1”);ObjectDelete(“TDI_SIG2”);

ObjectDelete(“TDI_SIG3”);ObjectDelete(“TDI_SIG4”);ObjectDelete(“TDI_SIG5”);

ObjectDelete(“TDI_SIG6”);ObjectDelete(“TDI_SIG7”);ObjectDelete(“TDI_SIG8”);

ObjectDelete(“TDI_SIG9”);

//—-

return(0);

}

int start()

{

CreateLEVEL();

}

void Createline(string objName, double start, double end, color clr)

{

ObjectCreate(objName, OBJ_TREND,WindowFind(“Traders Dynamic Index Visual”),0, start, Time[0], end);

ObjectSet(objName, OBJPROP_COLOR, clr);

ObjectSet(objName, OBJPROP_STYLE, 2);

ObjectSet(objName, OBJPROP_RAY, false);

}

void DeleteCreateline()

{

ObjectDelete(UPPERLINE);ObjectDelete(LOWERLINE);ObjectDelete(MEDLINE);

}

void CreateLEVEL()

{ DeleteCreateline();

Createline(UPPERLINE, 68, 68,C’70,70,70′);

Createline(LOWERLINE, 50, 50,C’00,70,00′);

Createline(MEDLINE, 32, 32,C’70,70,70′);

double MA,RSI[];

ArrayResize(RSI,Volatility_Band);

int counted_bars=IndicatorCounted();

int limit = Bars-counted_bars-1;

for(int i=limit; i>=0; i–)

{

RSIBuf[i] = (iRSI(NULL,0,RSI_Period,RSI_Price,i));

MA = 0;

for(int x=i; x<i+Volatility_Band; x++) {

RSI[x-i] = RSIBuf[x];

MA += RSIBuf[x]/Volatility_Band;

}

UpZone[i] = (MA + (1.6185 * StDev(RSI,Volatility_Band)));

DnZone[i] = (MA – (1.6185 * StDev(RSI,Volatility_Band)));

MdZone[i] = ((UpZone[i] + DnZone[i])/2);

}

for (i=limit-1;i>=0;i–)

{

MaBuf[i] = (iMAOnArray(RSIBuf,0,RSI_Price_Line,0,RSI_Price_Type,i));

MbBuf[i] = (iMAOnArray(RSIBuf,0,Trade_Signal_Line,0,Trade_Signal_Type,i));

McBuf[i] = (iMAOnArray(RSIBuf,0,Trade_Signal_Line2,0,Trade_Signal_Type,i));

string Signal=””, Signal2=””,Signal2A=””, Signal3=””,Signal4=””,Signal5=””;

color TDI_col,TDI_col2,TDI_col3,TDI_col4;

if(Show_VISUAL_Alerts==true){

static double crossPrice;

int crossDirection;crossDirection =0;

//signals

if((MaBuf[0]>MbBuf[0])&&(MbBuf[0]<MdZone[0])&&(MaBuf[0]< MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal=”?;TDI_col=SeaGreen;}

if((MaBuf[0]>MbBuf[0])&&(MbBuf[0]<MdZone[0])&&(MaBuf[0]< MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal2A=”Weak Buy”;TDI_col2=SeaGreen;}

if((MaBuf[0]>MbBuf[0])&&(MbBuf[0]<MdZone[0])&&(MaBuf[0]< MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal2=” @ “+DoubleToStr(crossPrice,Digits)+””;TDI_col2=SeaGreen;}

if((MaBuf[0]>MbBuf[0])&&(MbBuf[0]<MdZone[0])&&(MaBuf[0]< MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){crossPrice = Bid;crossDirection =2;}

if((MaBuf[0]<MbBuf[0])&&(MbBuf[0]> MdZone[0])&&(MaBuf[0]> MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal=”?;TDI_col=Orange;}

if((MaBuf[0]<MbBuf[0])&&(MbBuf[0]> MdZone[0])&&(MaBuf[0]> MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal2A=”Weak Sell”;TDI_col2=Orange;}

if((MaBuf[0]<MbBuf[0])&&(MbBuf[0]> MdZone[0])&&(MaBuf[0]> MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal2=” @ “+DoubleToStr(crossPrice,Digits)+””;TDI_col2=Orange;}

if((MaBuf[0]<MbBuf[0])&&(MbBuf[0]> MdZone[0])&&(MaBuf[0]> MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){crossPrice = Bid;crossDirection =1;}

if((MaBuf[0]>MbBuf[0])&&(MbBuf[0]> MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal=”?;TDI_col=Lime;}

if((MaBuf[0]>MbBuf[0])&&(MbBuf[0]> MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal2A=”Strong Buy”;TDI_col2=Lime;}

if((MaBuf[0]>MbBuf[0])&&(MbBuf[0]> MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal2=” @ “+DoubleToStr(crossPrice,Digits)+””;TDI_col2=Lime;}

if((MaBuf[0]>MbBuf[0])&&(MbBuf[0]> MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){crossPrice = Bid;crossDirection =2;}

if((MaBuf[0]>MbBuf[0])&&(MaBuf[0]> MdZone[0])&&(MbBuf[0]< MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal2A=”Medium Buy”;TDI_col2=Green;}

if((MaBuf[0]>MbBuf[0])&&(MaBuf[0]> MdZone[0])&&(MbBuf[0]< MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal2=” @ “+DoubleToStr(crossPrice,Digits)+””;TDI_col2=Green;}

if((MaBuf[0]>MbBuf[0])&&(MaBuf[0]> MdZone[0])&&(MbBuf[0]< MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal5=”?;TDI_col2=Green;}

if((MaBuf[0]>MbBuf[0])&&(MaBuf[0]> MdZone[0])&&(MbBuf[0]< MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){crossPrice = Bid;crossDirection =2;}

if((MaBuf[0]<MbBuf[0])&&(MbBuf[0]< MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal=”?;TDI_col=Red;}

if((MaBuf[0]<MbBuf[0])&&(MbBuf[0]< MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal2A=”Strong Sell”;TDI_col2=Red;}

if((MaBuf[0]<MbBuf[0])&&(MbBuf[0]< MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal2=” @ “+DoubleToStr(crossPrice,Digits)+””;TDI_col2=Red;}

if((MaBuf[0]<MbBuf[0])&&(MbBuf[0]< MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){crossPrice = Bid;crossDirection =1;}

if((MaBuf[0]<MbBuf[0])&&(MaBuf[0]< MdZone[0])&&(MbBuf[0]> MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal2A=”Medium Sell”;TDI_col2=Tomato;}

if((MaBuf[0]<MbBuf[0])&&(MaBuf[0]< MdZone[0])&&(MbBuf[0]> MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal2=” @ “+DoubleToStr(crossPrice,Digits)+””;TDI_col2=Tomato;}

if((MaBuf[0]<MbBuf[0])&&(MaBuf[0]< MdZone[0])&&(MbBuf[0]> MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){Signal5=”?;TDI_col2=Tomato;}

if((MaBuf[0]<MbBuf[0])&&(MaBuf[0]< MdZone[0])&&(MbBuf[0]> MdZone[0])&&(MaBuf[0]>32)&&(MaBuf[0]<68)){crossPrice = Bid;crossDirection =1;}

// reversals

if(MaBuf[0]>=68){Signal=”?;TDI_col=Red;}

if(MaBuf[0]>=68){crossPrice = Bid;crossDirection =2;}

if(MaBuf[0]>=68){Signal2A=”Caution !”;TDI_col2=Red;}

if(MaBuf[0]>=68){Signal2=” @ “+DoubleToStr(crossPrice,Digits)+””;TDI_col2=Red;}

if(MaBuf[0]<=32){Signal=”?;TDI_col=Red;}

if(MaBuf[0]<=32){crossPrice = Bid;crossDirection =1;}

if(MaBuf[0]<=32){Signal2A=”Caution !”;TDI_col2=Red;}

if(MaBuf[0]<=32){Signal2=” @ “+DoubleToStr(crossPrice,Digits)+””;TDI_col2=Red;}

//trend

if(MbBuf[0]>MdZone[0]){Signal3=”?;TDI_col3=Lime;}

if((MbBuf[0]<MdZone[0])&&(MaBuf[0]>MdZone[0])){Signal3=”?;TDI_col3=Orange;}

if(MbBuf[0]<MdZone[0]){Signal3=”?;TDI_col3=Red;}

if((MbBuf[0]>MdZone[0])&&(MaBuf[0]<MdZone[0])){Signal3=”?;TDI_col3=Green;}

//ranging

if(UpZone[0]-DnZone[i]<20){Signal4=”Consolidation”;TDI_col4=Silver;}

ObjectDelete(“TDI_SIG”);

ObjectCreate(“TDI_SIG”, OBJ_LABEL,WindowFind(“Traders Dynamic Index Visual”), 0, 0);

ObjectSetText(“TDI_SIG”,Signal, 25, “Wingdings”,TDI_col );

ObjectSet(“TDI_SIG”, OBJPROP_CORNER, 1);

ObjectSet(“TDI_SIG”, OBJPROP_XDISTANCE, 80+SHIFT_Sideway);

ObjectSet(“TDI_SIG”, OBJPROP_YDISTANCE, 20+SHIFT_Up_Down);

ObjectDelete(“TDI_SIG1”);

ObjectCreate(“TDI_SIG1”, OBJ_LABEL,WindowFind(“Traders Dynamic Index Visual”), 0, 0);

ObjectSetText(“TDI_SIG1”,Signal2, 15, “Tahoma Narrow”,TDI_col2);

ObjectSet(“TDI_SIG1”, OBJPROP_CORNER, 1);

ObjectSet(“TDI_SIG1”, OBJPROP_XDISTANCE, 120+SHIFT_Sideway);

ObjectSet(“TDI_SIG1”, OBJPROP_YDISTANCE, 30+SHIFT_Up_Down);

ObjectDelete(“TDI_SIG2”);

ObjectCreate(“TDI_SIG2”, OBJ_LABEL,WindowFind(“Traders Dynamic Index Visual”), 0, 0);

ObjectSetText(“TDI_SIG2”,Signal2A, 15, “Tahoma Narrow”,TDI_col2);

ObjectSet(“TDI_SIG2”, OBJPROP_CORNER, 1);

ObjectSet(“TDI_SIG2”, OBJPROP_XDISTANCE, 120+SHIFT_Sideway);

ObjectSet(“TDI_SIG2”, OBJPROP_YDISTANCE, 10+SHIFT_Up_Down);

ObjectDelete(“TDI_SIG3”);

ObjectCreate(“TDI_SIG3”, OBJ_LABEL,WindowFind(“Traders Dynamic Index Visual”), 0, 0);

ObjectSetText(“TDI_SIG3”,Signal5, 25, “Wingdings”,TDI_col2 );

ObjectSet(“TDI_SIG3”, OBJPROP_CORNER, 1);

ObjectSet(“TDI_SIG3”, OBJPROP_XDISTANCE, 80+SHIFT_Sideway);

ObjectSet(“TDI_SIG3”, OBJPROP_YDISTANCE, 20+SHIFT_Up_Down);

ObjectDelete(“TDI_SIG4”);

ObjectCreate(“TDI_SIG4”, OBJ_LABEL,WindowFind(“Traders Dynamic Index Visual”), 0, 0);

ObjectSetText(“TDI_SIG4”,Signal3, 25, “Wingdings”,TDI_col3 );

ObjectSet(“TDI_SIG4”, OBJPROP_CORNER, 1);

ObjectSet(“TDI_SIG4”, OBJPROP_XDISTANCE, 80+SHIFT_Sideway);

ObjectSet(“TDI_SIG4”, OBJPROP_YDISTANCE, 55+SHIFT_Up_Down);

ObjectDelete(“TDI_SIG5”);

ObjectCreate(“TDI_SIG5”, OBJ_LABEL,WindowFind(“Traders Dynamic Index Visual”), 0, 0);

ObjectSetText(“TDI_SIG5″,”TDI Trend”, 15, “Tahoma Narrow”,TDI_col3 );

ObjectSet(“TDI_SIG5”, OBJPROP_CORNER, 1);

ObjectSet(“TDI_SIG5”, OBJPROP_XDISTANCE, 120+SHIFT_Sideway);

ObjectSet(“TDI_SIG5”, OBJPROP_YDISTANCE, 60+SHIFT_Up_Down);

ObjectDelete(“TDI_SIG6”);

ObjectCreate(“TDI_SIG6”, OBJ_LABEL,WindowFind(“Traders Dynamic Index Visual”), 0, 0);

ObjectSetText(“TDI_SIG6”,Signal4, 15, “Tahoma Narrow”,TDI_col4 );

ObjectSet(“TDI_SIG6”, OBJPROP_CORNER, 1);

ObjectSet(“TDI_SIG6”, OBJPROP_XDISTANCE, 100+SHIFT_Sideway);

ObjectSet(“TDI_SIG6”, OBJPROP_YDISTANCE, 100+SHIFT_Up_Down);}

//line numbers

ObjectDelete(“TDI_SIG7”);

ObjectDelete(“TDI_SIG7”);

if(ObjectFind(“TDI_SIG7”) != 0) {

ObjectCreate(“TDI_SIG7”, OBJ_TEXT,WindowFind(“Traders Dynamic Index Visual”), Time[0],70);

ObjectSetText(“TDI_SIG7″,” 68 “,7, “Tahoma Narrow”,CadetBlue);

} else{ ObjectMove(“TDI_SIG7”, 0, Time[0], 70); }

ObjectDelete(“TDI_SIG8”);

ObjectDelete(“TDI_SIG8”);

if(ObjectFind(“TDI_SIG8”) != 0) {

ObjectCreate(“TDI_SIG8”, OBJ_TEXT,WindowFind(“Traders Dynamic Index Visual”), Time[0],52);

ObjectSetText(“TDI_SIG8″,” 50 “,7, “Tahoma Narrow”,CadetBlue);

} else{ ObjectMove(“TDI_SIG8”, 0, Time[0], 52); }

ObjectDelete(“TDI_SIG9”);

ObjectDelete(“TDI_SIG9”);

if(ObjectFind(“TDI_SIG9”) != 0) {

ObjectCreate(“TDI_SIG9”, OBJ_TEXT,WindowFind(“Traders Dynamic Index Visual”), Time[0],34);

ObjectSetText(“TDI_SIG9″,” 32 “,7, “Tahoma Narrow”,CadetBlue);

} else{ ObjectMove(“TDI_SIG9”, 0, Time[0], 34); }

}

//—-

return(0);

}

double StDev(double& Data[], int Per)

{return(MathSqrt(Variance(Data,Per)));

}

double Variance(double& Data[], int Per)

{double sum, ssum;

for (int i=0; i<Per; i++)

{sum += Data[i];

ssum += MathPow(Data[i],2);

}

return((ssum*Per – sum*sum)/(Per*(Per-1)));

}

//+——————————————————————+

相关资源

暂无评论...