//+——————————————————————+

#property copyright “Copyright © 2018, Brian Lillard”

#property description “Density $calper”

#property link “https://www.mql5.com/en/users/subgenius/seller”

#property version “1.00”

#property strict

/*************************************************************||

*** GLOBAL VARIABLES *****************************************

**************************************************************/

//- indicator buffers

//- signal identifiers

const int SELL=2,

BUY=1,

NA=0;

//- new bar log

bool isNewBar;

int min,sec;

//-logs for performance

//- spread calculations

int intSpreadMultiplier;

//- signals

bool bOuterUpper,bOuterLower,bInnerUpper,bInnerLower;

bool SignalThisBar=false;

int Signal;

//- order info

bool OrdersOpen;

int iInnerB,iOuterB,iInnerS,iOuterS;

int iInnerBL,iOuterBL,iInnerSL,iOuterSL;

double CumulativePL;

string EaComment=”D$”;

/*************************************************************||

*** ENUMERATED LISTS *****************************************

**************************************************************/

enum OptLot{Fixed=0,/*Fixed Lot*/EquityFull=1,/*% Equity Full*/EquitySplit=2,/*% Equity Split*/BalanceFull=3,/*% Balance Full*/BalanceSplit=4,/*% Balance Split*/};

/*************************************************************||

*** EXTERNAL INPUTS ******************************************

**************************************************************/

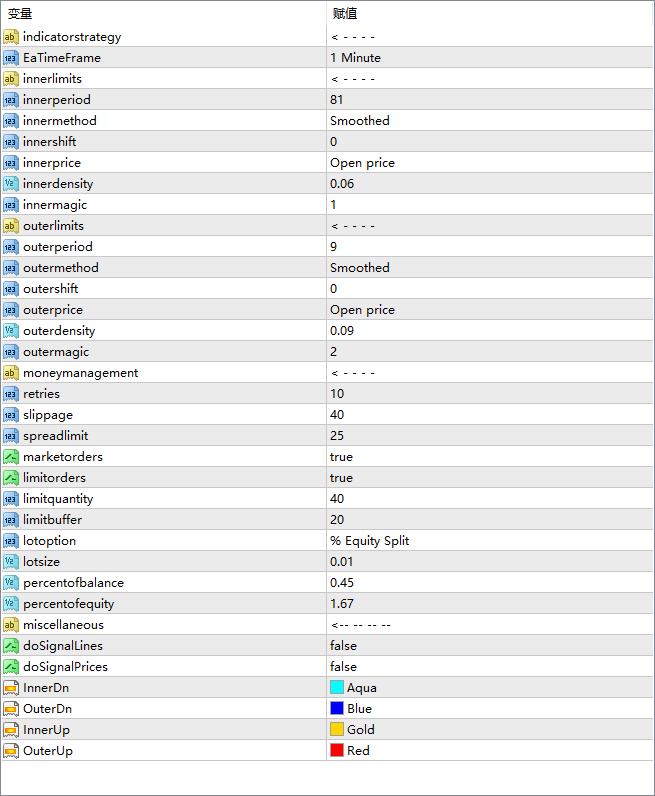

input string indicatorstrategy = “< – – – – “;

input ENUM_TIMEFRAMES EaTimeFrame = PERIOD_M1;

bool trailexits = true;

input string innerlimits = “< – – – – “;

input int innerperiod = 81;

input ENUM_MA_METHOD innermethod = MODE_SMMA;

input int innershift = 0;

input ENUM_APPLIED_PRICE innerprice = PRICE_OPEN;

input double innerdensity = 0.06;

input int innermagic = 1;

input string outerlimits = “< – – – – “;

input int outerperiod = 9;

input ENUM_MA_METHOD outermethod = MODE_SMMA;

input int outershift = 0;

input ENUM_APPLIED_PRICE outerprice = PRICE_OPEN;

input double outerdensity = 0.09;

input int outermagic = 2;

input string moneymanagement = “< – – – – “;

input int retries = 10;

input int slippage = 40;

input int spreadlimit = 25;

input bool marketorders = TRUE;

input bool limitorders = TRUE;

input int limitquantity = 40;

input int limitbuffer = 20;

input OptLot lotoption = EquitySplit;

input double lotsize = 0.01;

input double percentofbalance = 0.45;

input double percentofequity = 1.67;

input string miscellaneous = “<– — — — “;

bool doLabels = FALSE;

color FontColor = DarkKhaki;

string Font = “Calibri”;

int FontSize = 7;

int Corner = 1;

input bool doSignalLines = FALSE;

input bool doSignalPrices = FALSE;

input color InnerDn = Aqua;

input color OuterDn = Blue;

input color InnerUp = Gold;

input color OuterUp = Red;

/*************************************************************||

*** INDICATOR CODE *******************************************

**************************************************************/

double inner(int buffer,int bar){ return( iEnvelopes(NULL,0,innerperiod,innermethod,innershift,innerprice,innerdensity,buffer,bar) ); }

double outer(int buffer,int bar){ return( iEnvelopes(NULL,0,outerperiod,outermethod,outershift,outerprice,outerdensity,buffer,bar) ); }

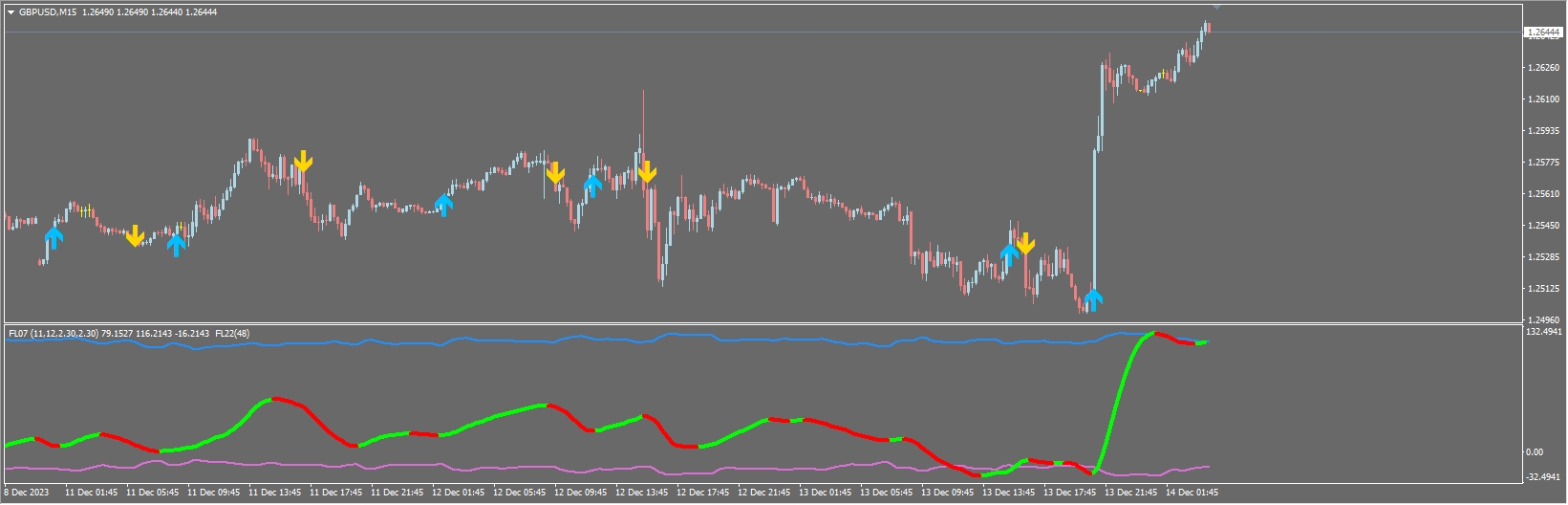

void getSignals(int i)

{

Signal=NA;

double OuterUpper=outer(MODE_UPPER,i); bOuterUpper=false;

double OuterLower=outer(MODE_LOWER,i); bOuterLower=false;

double InnerUpper=inner(MODE_UPPER,i); bInnerUpper=false;

double InnerLower=inner(MODE_LOWER,i); bInnerLower=false;

if( Low[i]<=OuterLower && High[i]>=OuterLower ) //outer signals

{ Signal=BUY; bOuterLower=TRUE;

if(doSignalLines){ VLINE(“VLINEO”+IntegerToString(i),Time[i],Red,3); }

if(doSignalPrices){ ARROW(“ARROWO”+IntegerToString(i),Time[i],OuterLower,4,OuterUp); } }

if( High[i]>=OuterUpper && Low[i]<=OuterUpper )

{ Signal=SELL; bOuterUpper=TRUE;

if(doSignalLines){ VLINE(“VLINEO”+IntegerToString(i),Time[i],Blue,3); }

if(doSignalPrices){ ARROW(“ARROWO”+IntegerToString(i),Time[i],OuterUpper,4,OuterDn); } }

if( OuterUpper>InnerUpper && OuterLower<InnerLower ) //inner signals

{

if( Low[i]<=InnerLower && High[i]>=InnerLower )

{ Signal=BUY; bInnerLower=TRUE;

if(doSignalLines){ VLINE(“VLINEI”+IntegerToString(i),Time[i],Gold,1); }

if(doSignalPrices){ ARROW(“ARROWI”+IntegerToString(i),Time[i],InnerLower,4,InnerUp); } }

if( High[i]>=InnerUpper && Low[i]<=InnerUpper )

{ Signal=SELL; bInnerUpper=TRUE;

if(doSignalLines){ VLINE(“VLINEI”+IntegerToString(i),Time[i],Aqua,1); }

if(doSignalPrices){ ARROW(“ARROWI”+IntegerToString(i),Time[i],InnerUpper,4,InnerDn); } }

}

}

/*************************************************************||

*** MINI-FUNCTIONS *******************************************

**************************************************************/

bool bGoodSpread(){ if((spreadlimit>0 && NormalizeDouble((Ask-Bid)*intSpreadMultiplier,1)<=spreadlimit) || spreadlimit<=0){return(TRUE);} return(FALSE); }

bool bWrongTF(){ if(EaTimeFrame!=0){ if(strPeriod(Period())!=strPeriod(EaTimeFrame)){ return(TRUE); } } return(false); }

string strSignal(int iSS){if(iSS==1 || iSS==3){return(“BUY”);}if(iSS==2 || iSS==4){return(“SELL”);}return(“NA”);}

bool bNewBar(){ static datetime B1T; if(B1T!=Time[0]){ B1T=Time[0]; return(true); } return(false); }

bool Expire(){ if(CurTime()>=StrToTime(“2018.08.11”)){return(TRUE);} return(false); }

string strPeriod(int Per)

{

if(Per==0){ Per=Period(); } if(Per==1){ return(“M1”); } if(Per==5){ return(“M5”); }

if(Per==15){ return(“M15”); } if(Per==30){ return(“M30”); } if(Per==60){ return(“H1”); }

if(Per==240){ return(“H4”); } if(Per==1440){ return(“D1”); } if(Per==10080){ return(“W1”); }

if(Per==43200){ return(“MN”); } return(“{ Unknown Timeframe }”);

}

/*************************************************************||

*** OPEN AND CLOSED TRADE POOL *******************************

**************************************************************/

bool OpenOrdersFound()

{

iInnerBL=0; iOuterBL=0; iInnerSL=0; iOuterSL=0;

iInnerB=0; iOuterB=0; iInnerS=0; iOuterS=0;

CumulativePL=0;

int OrdersOT=OrdersTotal();

for(int X=0; X<OrdersOT; X++)

{

if(!OrderSelect(X,SELECT_BY_POS,MODE_TRADES) ){continue;}

if( OrderMagicNumber()==innermagic )

{

if( OrderType()==OP_SELLLIMIT ){ iInnerSL++; }else if( OrderType()==OP_BUYLIMIT ){ iInnerBL++; }

if( OrderType()==OP_SELL ){ iInnerS++; }else if( OrderType()==OP_BUY ){ iInnerB++; }

}

else

{

if( OrderMagicNumber()==outermagic )

{

if( OrderType()==OP_SELLLIMIT ){ iOuterSL++; }else if( OrderType()==OP_BUYLIMIT ){ iOuterBL++; }

if( OrderType()==OP_SELL ){ iOuterS++; }else if( OrderType()==OP_BUY ){ iOuterB++; }

}

}

CumulativePL+=OrderProfit()+OrderCommission()+OrderSwap();

}

if( iInnerS+iInnerB+iOuterS+iOuterB>0 ){ return(true); }

return(false);

}

/*************************************************************||

*** INITIALIZE ***********************************************

**************************************************************/

int OnInit()

{

if( Expire() ){ return(0); }

else{ Print(“Trial version expires 2018.08.11 – Copyright© 2018, Brian Lillard( 1proftprof35@gmail.com )”); }

if( doSignalLines || doSignalPrices ){ for(int i=Bars-1; i>=0; i–){ getSignals(i); } }

switch(Digits)

{

case 5: intSpreadMultiplier=100000; break;

case 4: intSpreadMultiplier= 10000; break;

case 3: intSpreadMultiplier= 1000; break;

case 2: intSpreadMultiplier= 100; break;

case 1: intSpreadMultiplier= 10; break;

default: break;

}

return(INIT_SUCCEEDED);

}

/*************************************************************||

*** ONTICK ***************************************************

**************************************************************/

void OnTick()

{

if( Expire() ){ Comment(“The trial version has expired!”); return; }

if(bWrongTF()){ Comment(“ERROR: Wrong Timeframe”); return; }

isNewBar=bNewBar(); if(isNewBar){ if( CumulativePL>0 ){ CloseAllOrders(innermagic); CloseAllOrders(outermagic); } SignalThisBar=false; }

OrdersOpen=OpenOrdersFound();

getSignals(0);

if( CumulativePL>0 ){ CloseAllOrders(innermagic); CloseAllOrders(outermagic); }

//if alternate inner signal then delete all inner signal expiry, close, and open new positions

//if alternate outer signal then delete all outer signal expiry, close, and open new positions

if( Signal!=0 && !SignalThisBar && bGoodSpread() )

{

switch(Signal)

{

case 1: //BUY

if( bInnerLower )

{

if( iInnerSL+iOuterSL>0 ){ DeleteOrders(innermagic); }

if( iInnerS+iOuterS>0 ){ CloseAllOrders(innermagic); }

Trade(innermagic);

}

if( bOuterLower )

{

if( iInnerSL+iOuterSL>0 ){ DeleteOrders(innermagic); }

if( iInnerS+iOuterS>0 ){ CloseAllOrders(innermagic); }

Trade(outermagic);

}

break;

case 2: //SELL

if( bInnerUpper )

{

if( iInnerBL+iOuterBL>0 ){ DeleteOrders(outermagic); }

if( iInnerB+iOuterB>0 ){ CloseAllOrders(outermagic); }

Trade(innermagic);

}

if( bOuterUpper )

{

if( iInnerBL+iOuterBL>0 ){ DeleteOrders(outermagic); }

if( iInnerB+iOuterB>0 ){ CloseAllOrders(outermagic); }

Trade(outermagic);

}

break;

default: break;

}

}

}

/*************************************************************||

*** DEINITIALIZE *********************************************

**************************************************************/

void OnDeinit(const int reason)

{

if( doSignalLines )

{

for(int i=Bars; i>=0; i–)

{

ObjectDelete(0,”VLINEO”+IntegerToString(i));

ObjectDelete(0,”VLINEI”+IntegerToString(i));

ObjectDelete(0,”ARROWO”+IntegerToString(i));

ObjectDelete(0,”ARROWI”+IntegerToString(i));

}

}

HideTestIndicators(true);

Comment(“”);

}

/*************************************************************||

*** TRAIL POSITIONS ******************************************

**************************************************************/

/*************************************************************||

*** MANAGE EXPIRY ********************************************

**************************************************************/

void DeleteOrders(int iMagic)

{

for(int OrdersOT=OrdersTotal()-1; OrdersOT>=0; OrdersOT–)

{

if(!OrderSelect(OrdersOT,SELECT_BY_POS,MODE_TRADES) || OrderMagicNumber()!=iMagic || OrderType()<2){continue;}

bool del=OrderDelete(OrderTicket()); ObjectsDeleteAll(0,0,OBJ_ARROW);

if(!del){ Print(“Deletion of Expired Order error: “,strError(GetLastError())); }

}

}

/*************************************************************||

*** EXIT POSITIONS *******************************************

**************************************************************/

void CloseAllOrders(int iMagic)

{

bool result=false; int iRetries;

for(int OrdersOT=OrdersTotal()-1; OrdersOT>=0; OrdersOT–)

{

if(!OrderSelect(OrdersOT,SELECT_BY_POS,MODE_TRADES) || OrderMagicNumber()!=iMagic || OrderType()>1){continue;}

result=false; iRetries=1;

while( iRetries<=retries && !result)

{

while(IsTradeContextBusy()){Sleep(10);} result=OrderClose(OrderTicket(),OrderLots(),OrderClosePrice(),slippage,clrNONE); iRetries++;

}

if(!result){Print(“Failed To Close Order#”+IntegerToString(OrderTicket())+”. Error: “+strError(GetLastError())+”.” ); }

}

}

/*************************************************************||

*** OPEN POSITIONS *******************************************

**************************************************************/

void Trade(int iMagic)

{

if(IsStopped() || !IsTradeAllowed()){ return; }

while(IsTradeContextBusy()){ Sleep(10); }

string sEAC=EaComment+”,”+strPeriod(Period())+”,”+DoubleToStr((Ask-Bid)*intSpreadMultiplier,1);

double SL=0,TP=0; double OpenPrice;

int ticket=0,iRetries=1;

switch(Signal)

{

case 1: //BUY

while( marketorders && ticket<=0 && iRetries<=retries )

{

ticket=OrderSend(Symbol(),OP_BUY,dNextLot(),Ask,slippage,0,0,sEAC,iMagic,0,MediumOrchid); iRetries++;

} if( marketorders && ticket<=0 ){ Print(“OrderSend Error: “,strError(GetLastError())); }

if( limitorders )

{

if( innerprice==PRICE_OPEN && outerprice==PRICE_OPEN ){ OpenPrice=Open[0]; }else{ OpenPrice=Ask; }

for( int i=1; i<=limitquantity; i++ )

{

ticket=OrderSend(Symbol(),OP_BUYLIMIT,dNextLot(),OpenPrice-(limitbuffer*Point()*(i)),slippage,0,0,sEAC,iMagic,0,MediumOrchid);

}

}

break;

case 2: //SELL

while( marketorders && ticket<=0 && iRetries<=retries )

{

ticket=OrderSend(Symbol(),OP_SELL,dNextLot(),Bid,slippage,0,0,sEAC,iMagic,0,Orange); iRetries++;

} if( marketorders && ticket<=0 ){ Print(“OrderSend Error: “,strError(GetLastError())); }

if( limitorders )

{

if( innerprice==PRICE_OPEN && outerprice==PRICE_OPEN ){ OpenPrice=Open[0]; }else{ OpenPrice=Bid; }

for( int i=1; i<=limitquantity; i++ )

{

ticket=OrderSend(Symbol(),OP_SELLLIMIT,dNextLot(),OpenPrice+(limitbuffer*Point()*(i)),slippage,0,0,sEAC,iMagic,0,Orange);

}

}

break;

default: break;

}

/*

if(ticket>0 && (TP>0 || SL>0))

{

while(IsTradeContextBusy()){Sleep(10);}

for(iRetries=retries; iRetries>0; iRetries–){ if(OrderModify(ticket,OrderOpenPrice(),SL,TP,0,clrNONE)){return;} }

}

*/

}

/*************************************************************||

*** MONEY MANAGEMENT *****************************************

**************************************************************/

double dNextLot()

{

int market=0; if(marketorders){ market=1; }

double Lot=0;

//rountine lots

if( lotoption==BalanceFull || lotoption==BalanceSplit ){ Lot=percentofbalance*AccountBalance()/10000; }

if( lotoption==EquityFull || lotoption==EquitySplit ){ Lot = percentofequity*AccountEquity()/10000; }

if(marketorders && limitorders && limitquantity>=1 && (lotoption==EquitySplit || lotoption==BalanceSplit)){ Lot=Lot/(limitquantity+market); }

//normalize bulk lot

if( Lot<NormalizeDouble(MarketInfo(Symbol(),MODE_MINLOT),2) ){ Lot=NormalizeDouble(MarketInfo(Symbol(),MODE_MINLOT),2); }

if( Lot>NormalizeDouble(MarketInfo(Symbol(),MODE_MAXLOT),2) ){ Lot=NormalizeDouble(MarketInfo(Symbol(),MODE_MAXLOT),2); }

return(NormalizeDouble(Lot,2));

}

/*************************************************************||

*** LABEL CODE ***********************************************

**************************************************************/

void ManageLabels()

{

//LABEL(“LABEL1”,”Spread/Max :: “+DoubleToString(MarketInfo(Symbol(),MODE_SPREAD),0)+”/”+DoubleToString(spreadlimit,1),9,18);

//LABEL(“LABEL2″,”Profit/Loss :: ” );

//+DoubleToString(CumulativePL,2),9,28);

//LABEL(“LABEL3″,”Sell Trades :: ” );

//+IntegerToString(intSellsOpen),9,38);

//LABEL(“LABEL4″,”Buy Trades :: ” );

//+IntegerToString(intBuysOpen),9,48);

//LABEL(“LABEL5″,”Trend :: ” );

//+strSignal(TMACMACD(0)),9,58);

//LABEL(“LABEL6″,”Signal :: ” );

//+strSignal(OHLCBREAKZ(0)),9,68);

}

void LABEL(string sName, string sText, int iX, int iY)

{

if(ObjectFind(sName)==-1){ ObjectCreate(sName,OBJ_LABEL,0,0,0); }

ObjectSetText(sName,sText,FontSize,Font,FontColor); ObjectSetString(0,sName,OBJPROP_TOOLTIP,sText);

ObjectSet(sName,OBJPROP_SELECTABLE,0); ObjectSet(sName,OBJPROP_CORNER,Corner);

ObjectSet(sName,OBJPROP_XDISTANCE,iX); ObjectSet(sName,OBJPROP_YDISTANCE,iY);

}

/*************************************************************||

*** ERROR MESSAGES *******************************************

**************************************************************/

string strError(int iError)

{

switch(iError)

{

case 0: return(“0: No Error”);

case 1: return(“1: No Error, Trade Conditions Not Changed”);

case 2: return(“2: Common Error”);

case 3: return(“3: Invalid Trade Parameters”);

case 4: return(“4: Trade Server Is Busy”);

case 5: return(“5: Old Version Of The Client Terminal”);

case 6: return(“6: No Connection With Trade Server”);

case 7: return(“7: Not Enough Rights”);

case 8: return(“8: Too Frequent Requests”);

case 9: return(“9: Malfunctional Rrade Operation(Never Returned Error)”);

case 64: return(“64: Account Disabled”);

case 65: return(“65: Invalid Account”);

case 128: return(“128: Trade Timeout”);

case 129: return(“129: Invalid Price”);

case 130: return(“130: Invalid Stops”);

case 131: return(“131: Invalid Trade Volume”);

case 132: return(“132: Market Is Closed”);

case 133: return(“133: Trade Is Disabled”);

case 134: return(“134: Not Enough Money”);

case 135: return(“135: Price Changed”);

case 136: return(“136: Off Quotes”);

case 137: return(“137: Broker Is Busy(Never Returned Error)”);

case 138: return(“138: Requote”);

case 139: return(“139: Order Is Locked”);

case 140: return(“140: Long Positions Only Allowed”);

case 141: return(“141: Too Many Requests”);

case 145: return(“145 Modification Denied Because Order Is Too Close To Market”);

case 146: return(“146: Trade Context Is Busy”);

case 147: return(“147: Expirations Are Denied By Broker”);

case 148: return(“148: Amount Of Open And Pending Orders Has Reached The Limit”);

case 149: return(“149: Hedging Is Prohibited”);

case 150: return(“150: Prohibited By FIFO Rules”);

}

return(“Unknown Error”);

}

void VLINE(string sName,datetime dTime,color cColor,int iWidth)

{

if(ObjectFind(sName)==-1){ ObjectCreate(sName,OBJ_VLINE,0,dTime,0,0); }

ObjectSet(sName,OBJPROP_COLOR,cColor);

ObjectSet(sName,OBJPROP_WIDTH,iWidth);

ObjectSet(sName,OBJPROP_BACK,true);

}

void ARROW(string sName,datetime dTime,double dPrice,int iArrow,color cColor)

{

if(ObjectFind(sName)==-1){ ObjectCreate(sName,OBJ_ARROW,0,0,0); }

ObjectSet(sName,OBJPROP_ARROWCODE,iArrow);

ObjectSet(sName,OBJPROP_TIME1,dTime);

ObjectSet(sName,OBJPROP_PRICE1,dPrice);

ObjectSet(sName,OBJPROP_COLOR,cColor);

if( cColor==InnerUp ){ ObjectSetString(0,sName,OBJPROP_TOOLTIP,”Inner Limit Buy”); }

if( cColor==InnerDn ){ ObjectSetString(0,sName,OBJPROP_TOOLTIP,”Inner Limit Sell”); }

if( cColor==OuterUp ){ ObjectSetString(0,sName,OBJPROP_TOOLTIP,”Outer Limit Buy”); }

if( cColor==OuterDn ){ ObjectSetString(0,sName,OBJPROP_TOOLTIP,”Outer Limit Sell”); }

}

DensityScalperEA这个源码下载地址打不开了

下载链接已经更新